Streamlining Carrier Settlement in SAP Transportation Management (TM)

In the fast-paced world of logistics, efficiency is key. One area where businesses can significantly enhance their operations is in the carrier settlement process. Traditionally, this process involves waiting for carrier invoices, which can lead to delays and inefficiencies. However, by automating the carrier settlement process in SAP Transportation Management and sending credit notes for freight costs instead, companies can achieve a more streamlined and effective workflow.

The ERS (Evaluated Receipt Settlement) procedure in SAP is not new and actually belongs to the Material Management module (MM), but with the embedded SAP TM solution, a few things might be tricky when it comes to setting up the process.

Process Overview

Let’s start with an overall process overview of the settlement process in SAP TM:

- A Freight Order (FO) is the object in SAP which is used to transport goods from A to B.

- Based on the freight order, a Freight Settlement Document (FSD) is created which carries the agreed freight charges. The calculation can happen automatically based on Freight Agreements (FA) or manually based on spot rates.

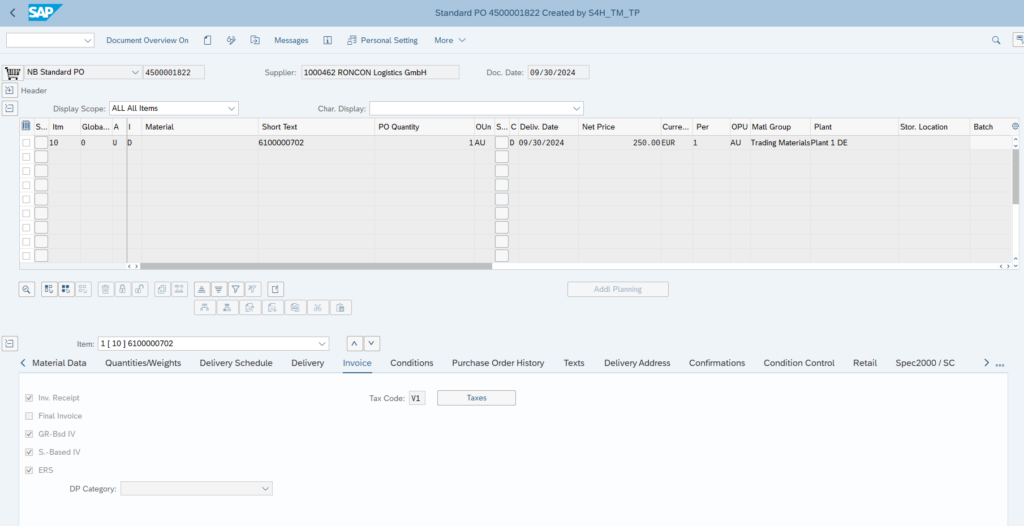

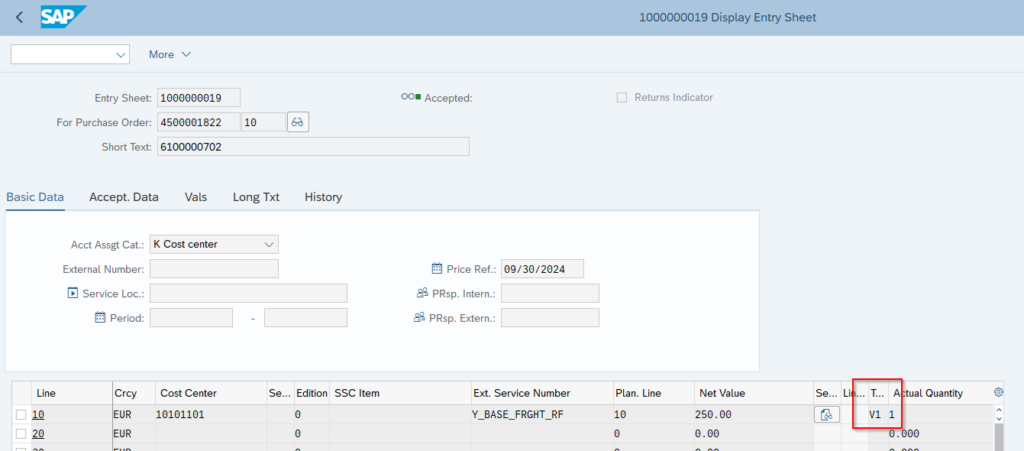

- When the FSD is posted, SAP creates a Purchase Order (PO) and posts a Service Entry Sheet (SES) for the costs to be paid to the carrier. This PO is not visible to the carrier. Only the FO was communicated to them. So the PO has a technical function, to build accruals for the charges to be paid and to post the incoming invoice from the vendor against it.

- The final step is to receive the vendor invoice, but with ERS procedure we create the invoice by ourself and submit the invoice proactively to our carrier.

- The ERS procedure requires to automatically determine the tax code in the Service Purchase Order.

🛠️ Following areas need to be customized so that the ERS process runs smoothly:

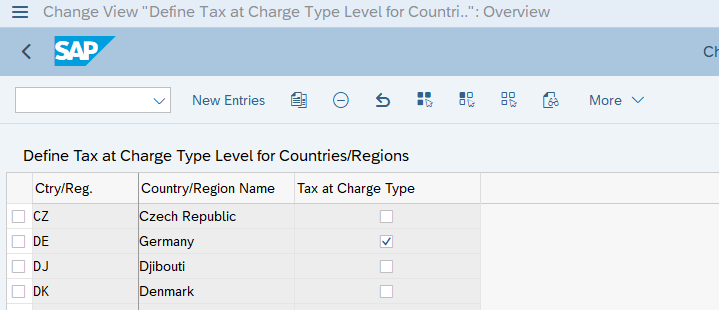

1.) Activate tax at charge type

SPRO: Transportation Management –> Settlement –> Freight Settlement –>Integration for Settlement Posting –>Tax

2.) Setup automatic tax code determination

The official help documentation regarding tax code determination can be found here: SAP TM Tax Determination but it’s not well explained from my point of view.

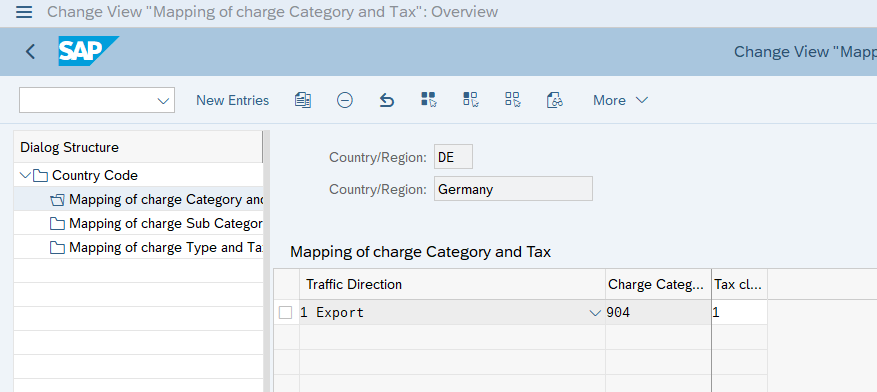

💡 Depending on the transportation route and the executing carrier, the transport costs must be taxed as domestic service, as reverse charge or w/o taxes for export business.

We need following criteria for the tax code determination

- Country of the service buying plant

- Country of the executing carrier

- Freight order departure country

- Freight order destination country

- Tax indicator (in case there are exceptions)

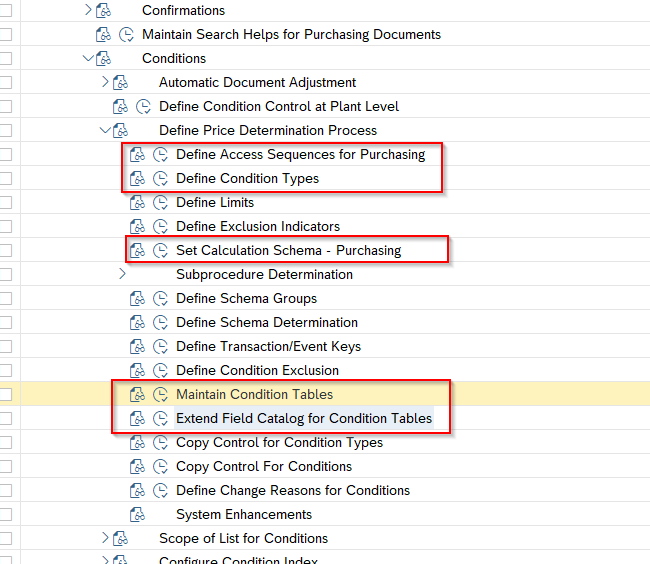

The SPRO items:

Now the steps in detail explained:

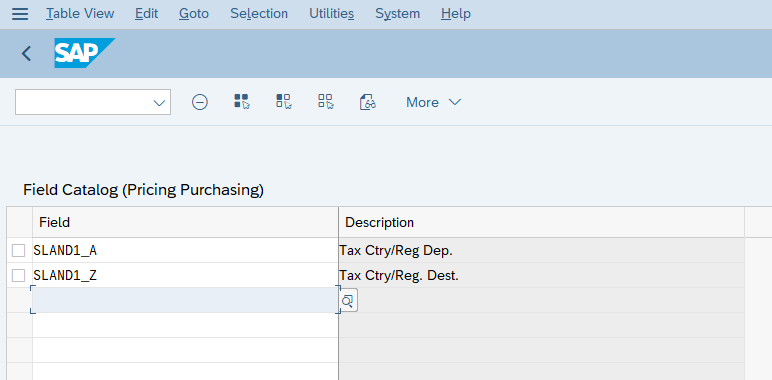

a.) Check if all required fields are available in the field catalog for condition tables.

In my case (version 2023) I needed to add the following two fields.

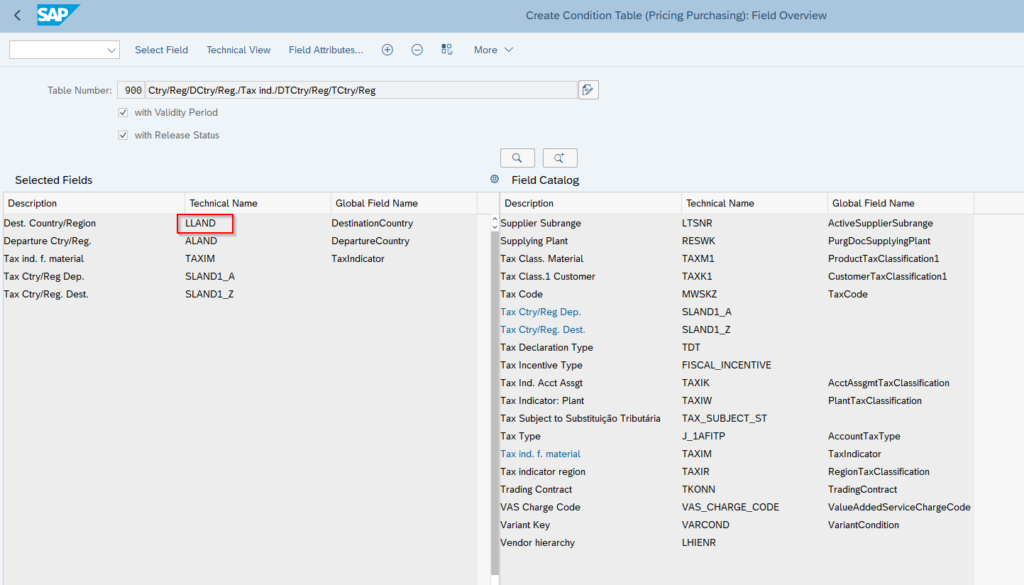

b.) Create a new condition table

⚠️Pay attention on the destination country field. In the SAP documentation, it is LAND1 but you must choose LLAND.

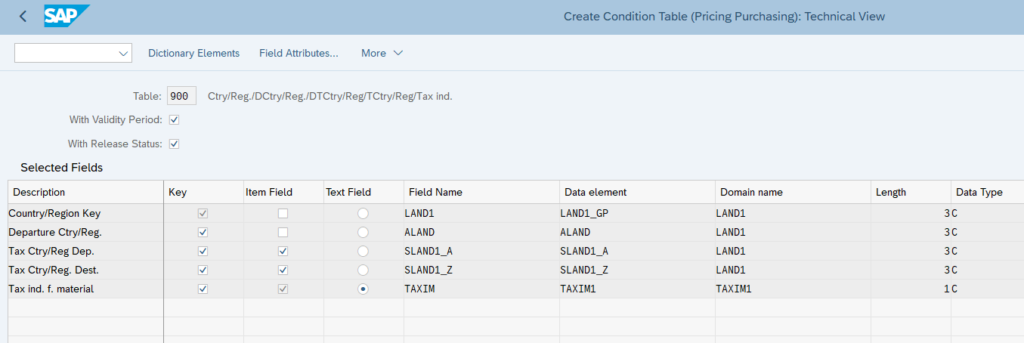

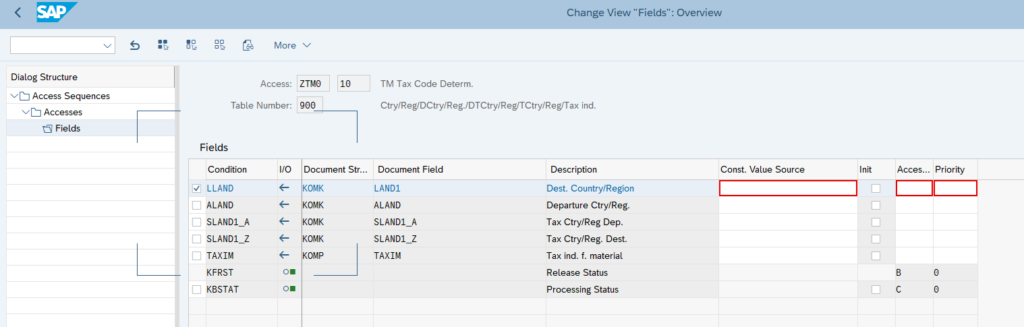

The technical view of the condition table should look like this

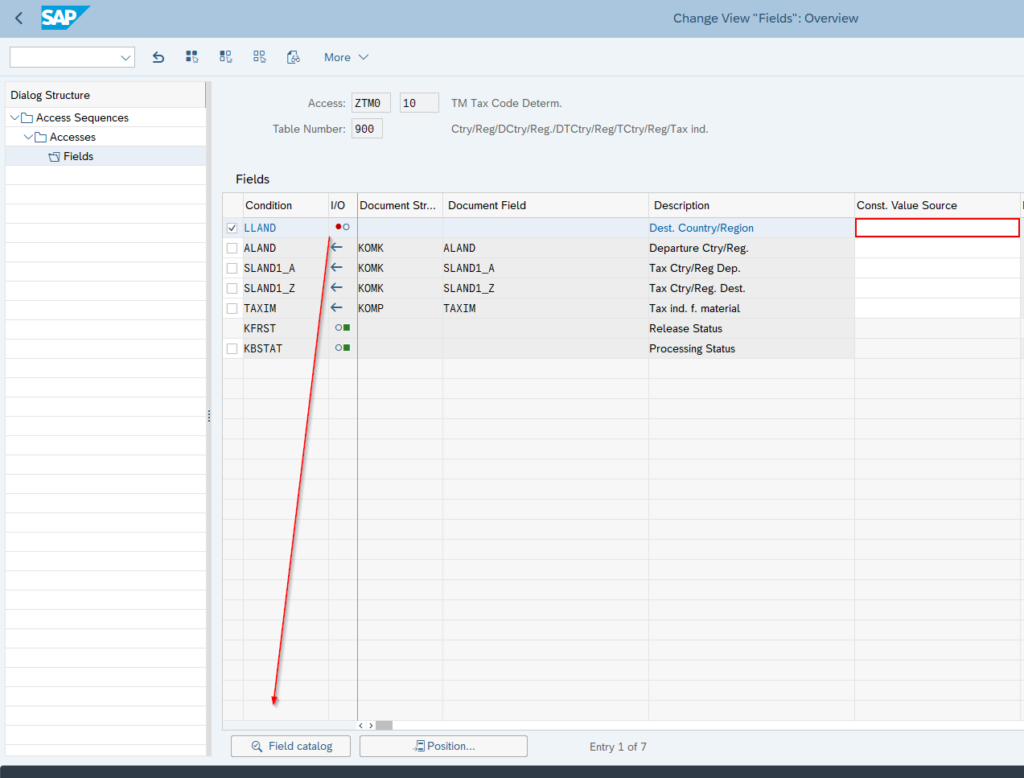

c.) Create an access sequence

Choose the created condition table. Most probably, you’ll see an error for LLAND. Select the field and click on “Field Catalog”. There you choose KOMK-LAND1. This is explained in SAP note 3121236

Now, the access sequence should have no errors.

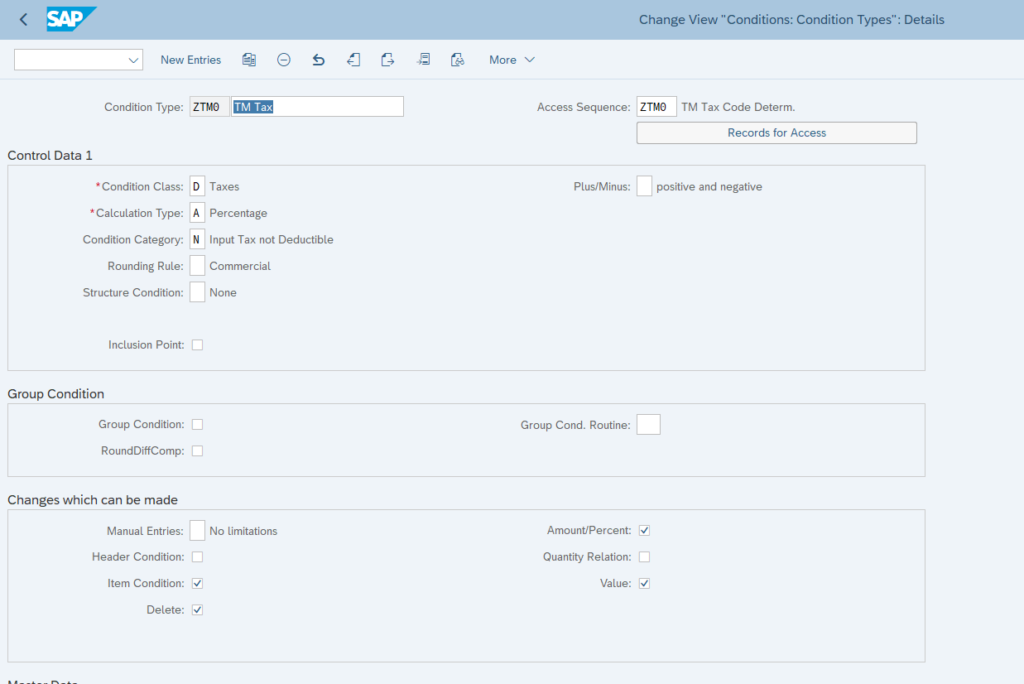

d.) Create a condition type for the tax

Maintain the data in Control Data 1 like on the screenshot and assign your new access sequence.

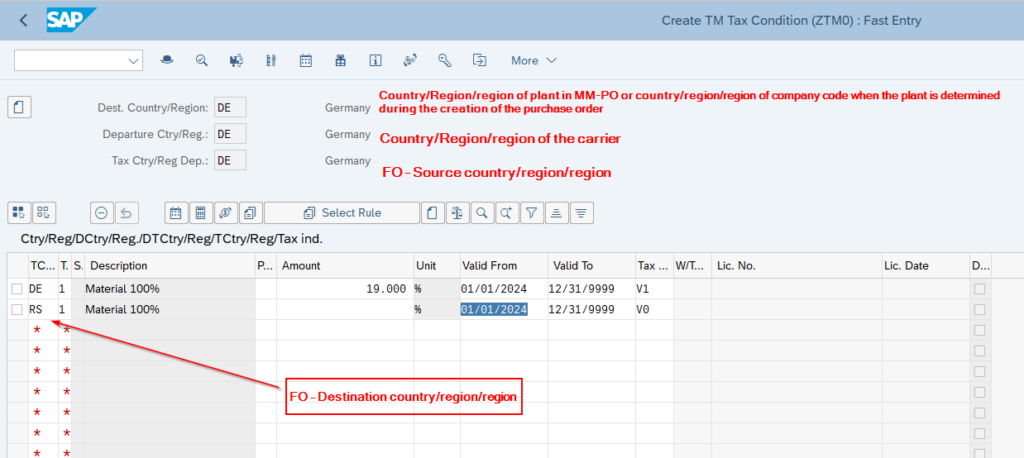

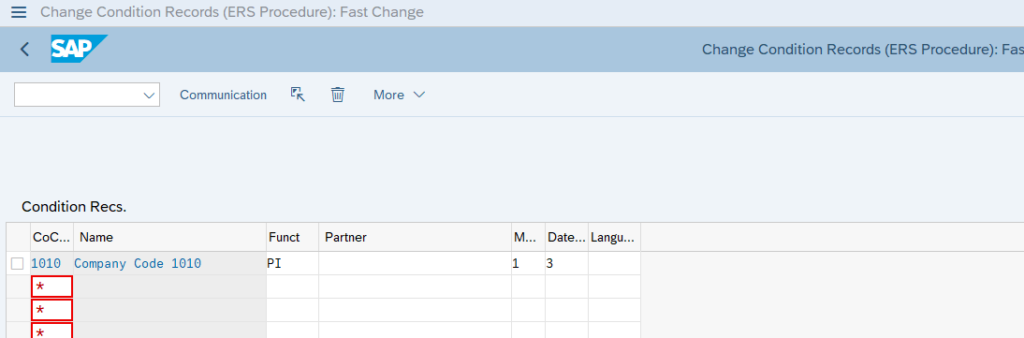

e.) Create the required condition records in transaction MEK1

In this example, our buying plant is in Germany and our carrier based in Germany as well. If the transport service is a domestic transport, then tax code V1 (full input tax) shall be assigned. If we export to Serbia (3rd country from EU perspective), then we assign tax code V0 (no tax). If the carrier is not a German company but based within the European Union, then you might need to add a tax code for “Reverse Charge”.

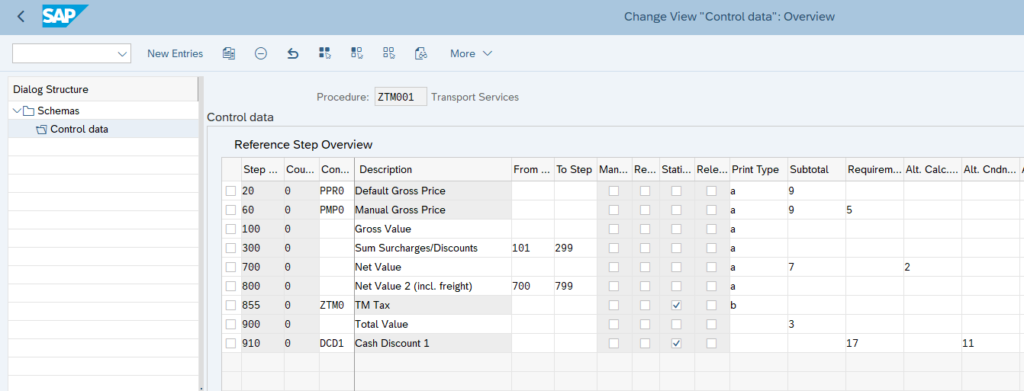

f.) Create or update PO pricing schema

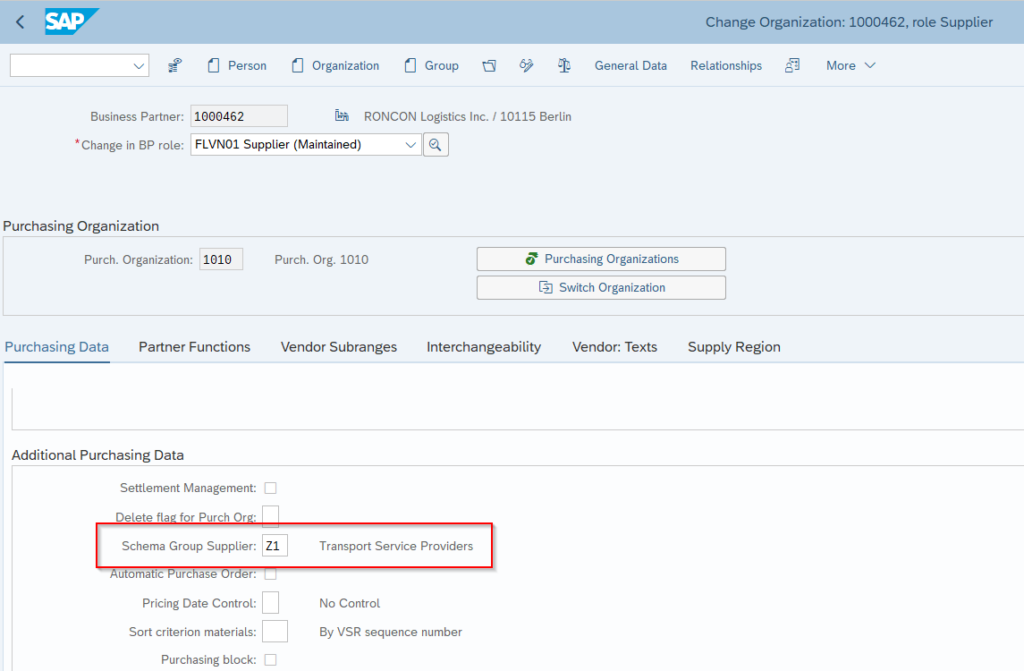

In my case, I created a dedicated pricing schema for carriers which is determined with a schema group assigned to the relevant vendors (carriers). Of course, you can add the new condition type to an existing pricing schema. You just need to assure that there is no conflict with an existing tax determination logic.

Pricing schema with new condition type

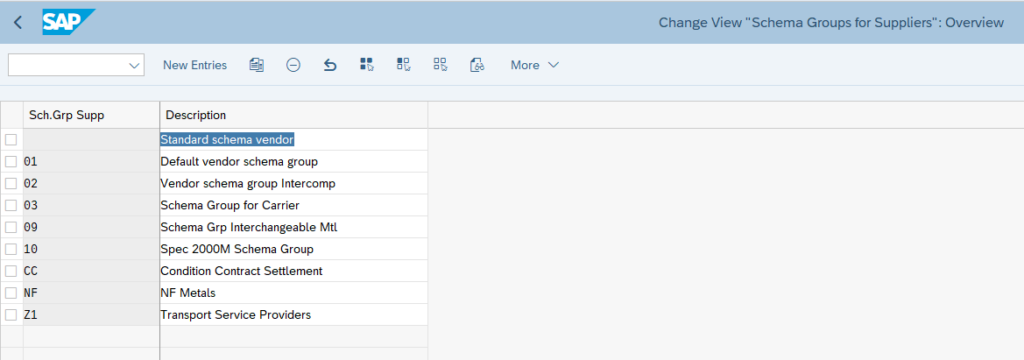

Schema group (Z1)

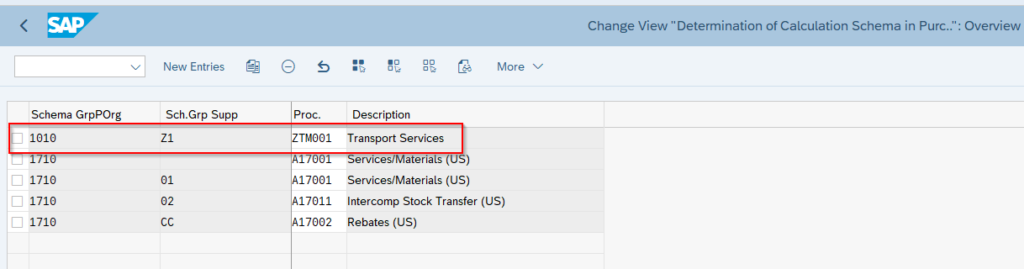

Schema determination

Assignment of the schema group in the vendor business partner

3.) Setup ERS invoice output

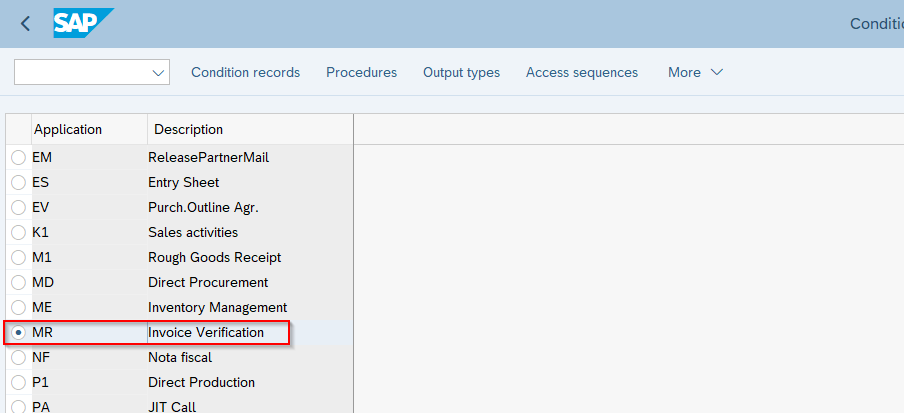

Go to transaction NACE, application MR and create a condition record for the output type ERS. If standard customizing is missing, copy it from client 000.

In this case, I want a print out, but in practice you might send the credit note via E-Mail.

4.) Activate ERS for the carrier in the BP master data

In the Vendor / Supplier role of your carrier, navigate to the desired purchasing organization, and activate the checkboxes for “GR-Based Inv. Verif” & “AutoGRSetmt.Ret”.

That should be all.

So now a quick process walk-through.

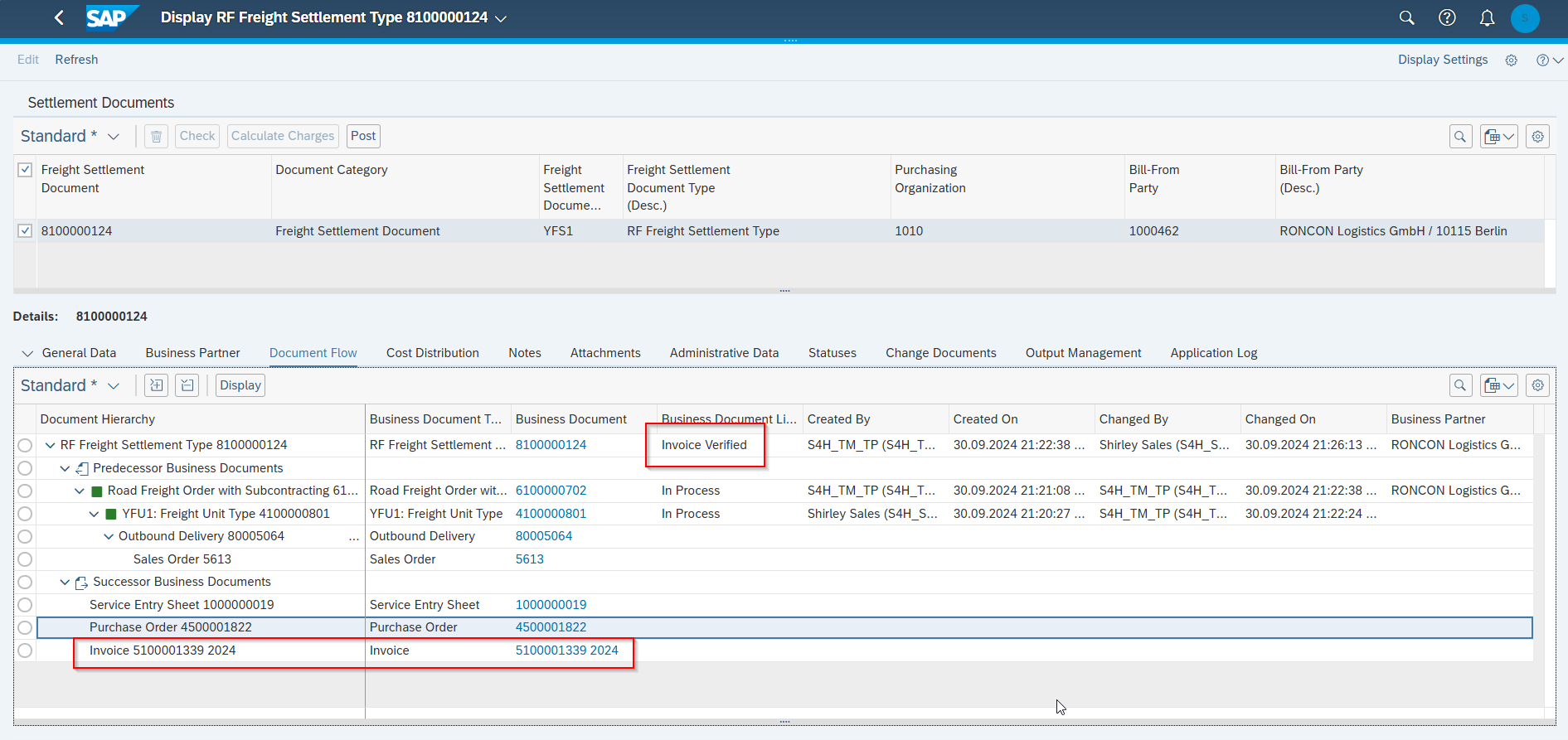

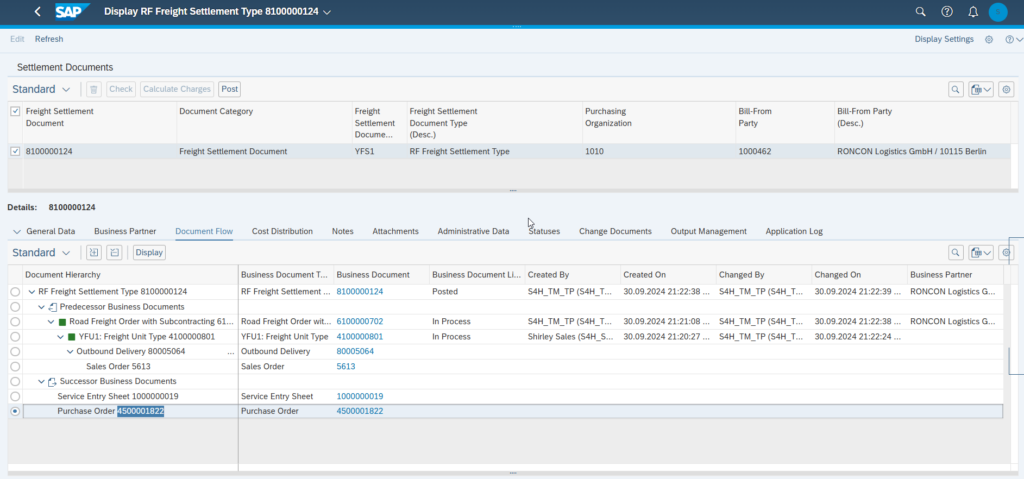

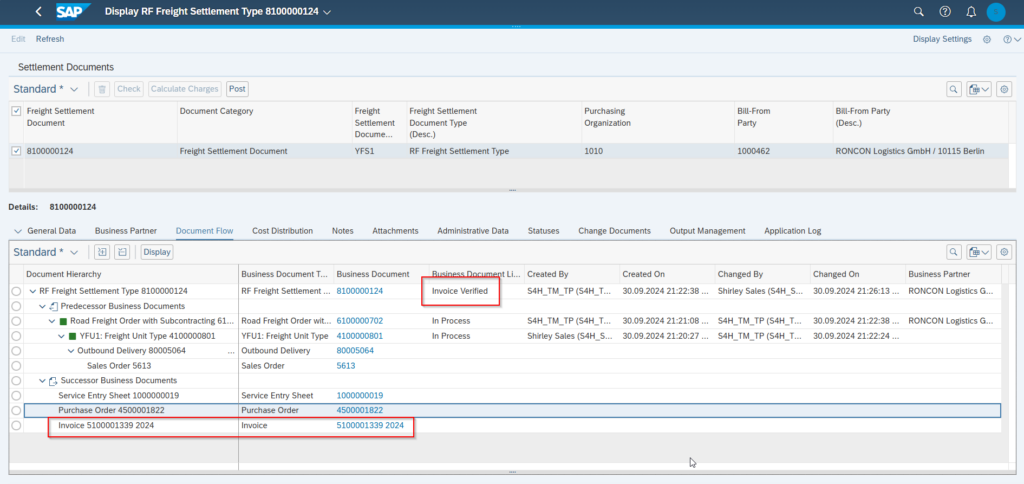

Freight Settlement Document

PO and Service Entry Sheet showing the correct tax code

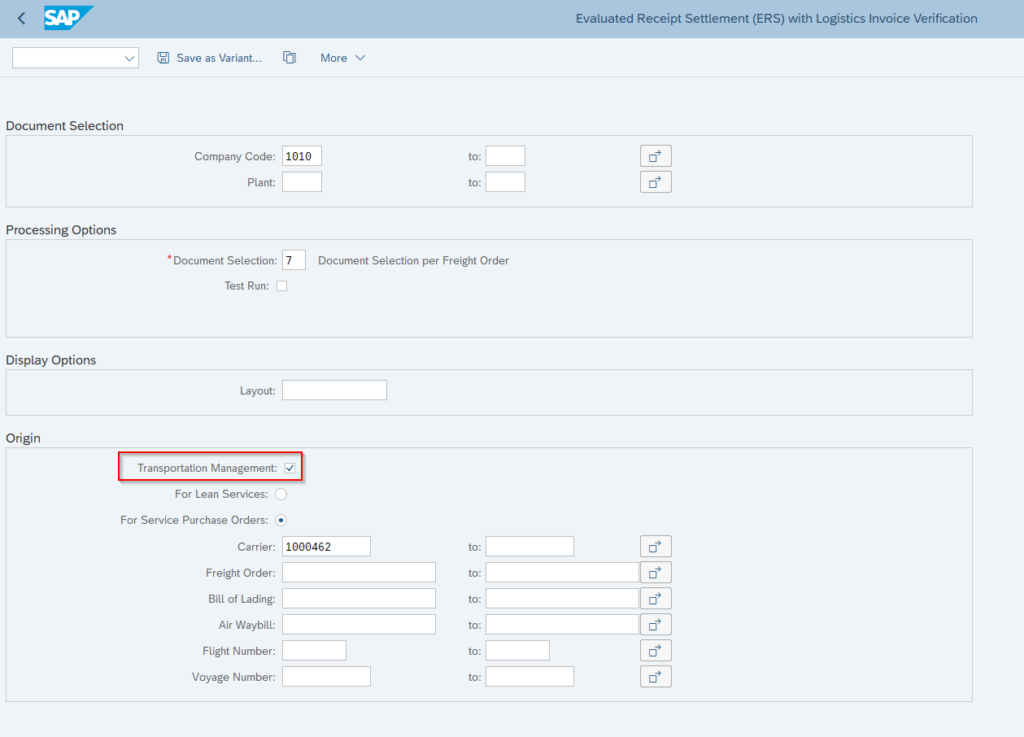

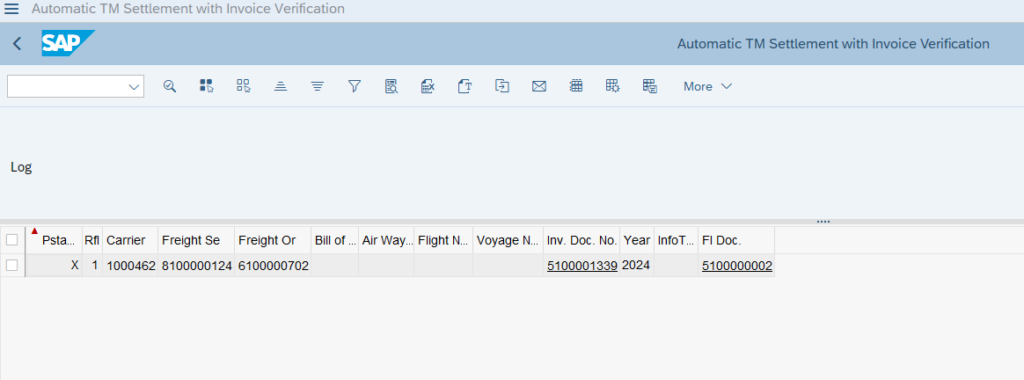

Transaction MRRL to trigger the creation of the credit note

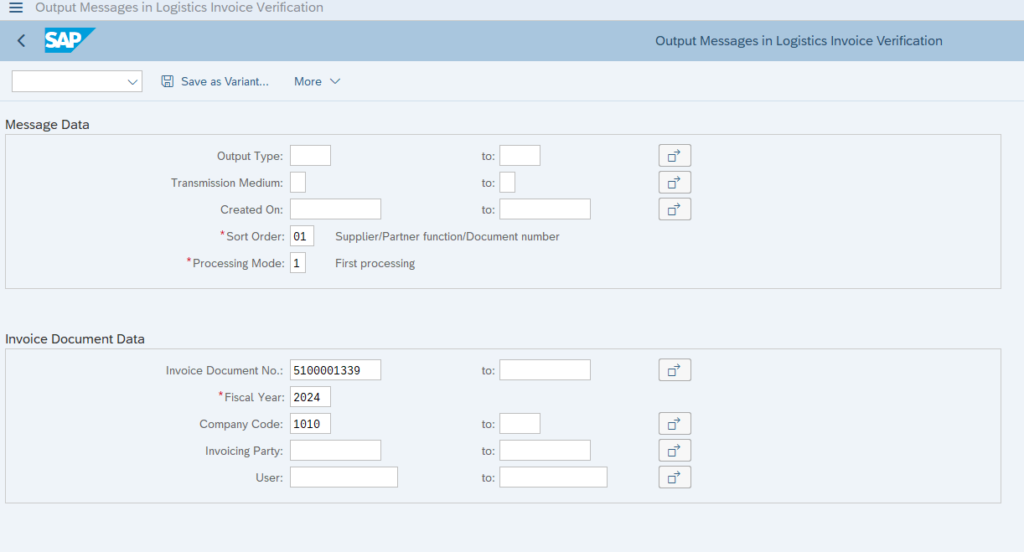

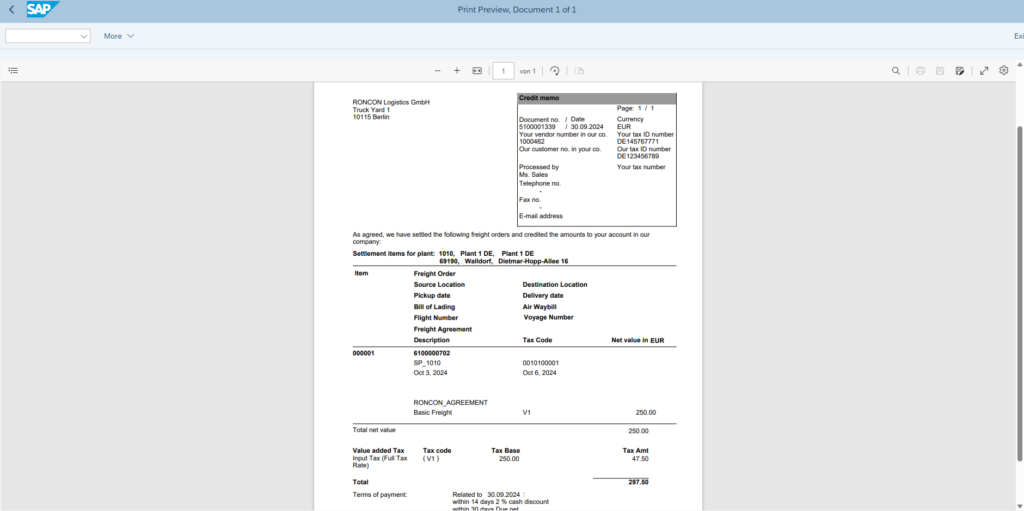

Transaction MR90 to trigger the output of the created credit note

Finally, the FSD is updated with the credit note and has status “Invoice Verified”.

💡The whole process with all the transactions / apps involved can be fully automated.

- Schedule report: /SCMTMS/SFIR_TRANSFER_BATCH to create FSD.

- Schedule SM37 jobs for MRRL and MR90.

Conclusion

In conclusion, creating credit notes for carriers is a more efficient approach than waiting for potentially incorrect invoices. This method not only speeds up the settlement process but also enhances accuracy and control over financial transactions. By automating this procedure, businesses can reduce administrative overhead, improve cash flow management, and ensure greater transparency in their operations. This shift towards credit notes ultimately leads to a more streamlined and reliable carrier settlement process.

References

- SAP Help Portal Tax Determination | SAP Help Portal

- SAP Community, AtulGokhale SAP S/4HANA Supply Chain Transportation Management… – SAP Community

- SAP Note 3121236 for condition table issues for field LLAND 3121236 – Zugriffsfolgen-Konditionstabellenfeldzuordnungsproblem – SAP for Me

- SAP Note 2424664 for tax code determination, master data setup 2424664 – Stammdateneinrichtung für Steuerkennzeichen in SAP TM und ERP – SAP for Me

- My Blog on SAP Community Using ERS for Carrier Settlement in SAP Transporta… – SAP Community